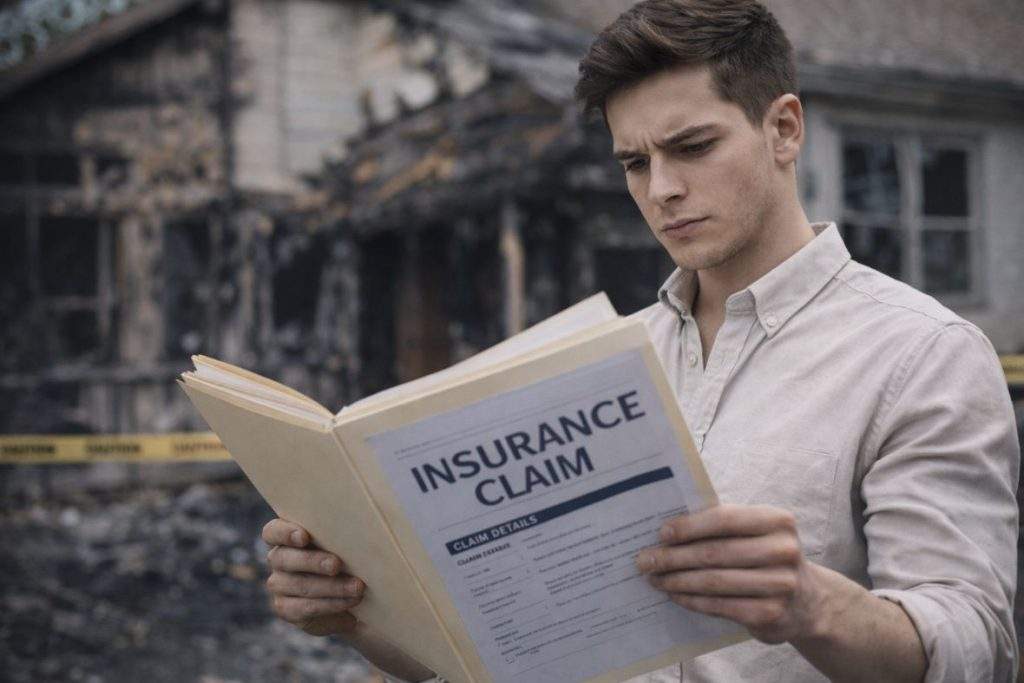

When an insurance claim seems too good to be true, it often is. Insurance fraud imposes a multi-billion-dollar burden on companies and policyholders every year, driving up premiums and diverting resources from legitimate claims. From staged car accidents and exaggerated workplace injuries to false property theft reports, the impact of fraudulent activity ripples across the economy. This is where the expertise of private investigators becomes critical.

Private investigators conducting professional insurance fraud investigations serve as the industry’s eyes and ears, fostering trust by providing reliable evidence when internal adjusters suspect deception. Their specialised skills and focus go far beyond what traditional corporate teams can achieve. By combining advanced investigative technology with classic detective work, they uncover evidence, verify claims, and ensure that honest policyholders are not forced to pay for someone else’s fraud. In a rapidly evolving insurance landscape, thorough insurance fraud investigations by private investigators are essential to securing financial accountability and upholding trust across the industry.

How Private Investigators Detect Insurance Fraud

Finding the truth in a sea of deceptive claims requires a strategic approach. Private investigators employ proven techniques such as surveillance, background checks, and digital forensics to gather evidence that is both accurate and legally sound. Their primary goal is to verify that the details of a claim match the reality of the situation, using methods that go beyond traditional questioning to uncover hidden discrepancies.

Legality is at the heart of every successful investigation. These experts are well-versed in privacy laws and legal boundaries for private investigators, ensuring that all proof is obtained without violating a subject’s rights. This meticulous attention to detail is what makes their findings valuable. By staying within the law, they give insurance companies the confidence to deny a false claim or pursue legal action without fear of procedural dismissal.

Conducting Surveillance and Field Work

Surveillance is the most well-known tool in a detective’s kit. It involves quietly observing a subject in public spaces to see if their physical actions contradict their reported limitations. For example, if someone claims they cannot walk without assistance due to a workplace mishap, an investigator might wait outside their home or follow them to a grocery store.

Video cameras are the preferred method for documenting these moments. High-quality footage provides undeniable proof of a person’s actual physical state. It is much harder to argue against a clear video showing a “disabled” person jogging than it is to dispute a written statement. This fieldwork requires immense patience and the ability to blend into the background, ensuring the subject never knows they are being watched.

Background Checks and Record Pulls

Beyond physical observation, investigators spend significant time looking into a person’s digital and paper trail. They conduct extensive background checks to determine whether the claimant has a history of filing similar reports. A pattern of frequent claims often points to “soft fraud,” where individuals treat insurance as a recurring source of income.

Paperwork can reveal a story the claimant might try to hide. Investigators pull medical records, previous employment history, and even social media activity. In many cases, people post photos of themselves on vacation or participating in sports while simultaneously collecting disability checks. By connecting these dots, private investigators build a comprehensive case that exposes fraud from multiple angles.

The Impact of Private Investigations on Fraud Cases

The intervention of a private investigator provides massive value to both insurance firms and legal teams. The most immediate benefit is cost savings. By identifying a fraudulent claim early, a company can stop a payout that might have reached hundreds of thousands of dollars. These savings eventually help stabilise insurance rates for the general public, making the system fairer for everyone.

A clear, detailed report from an investigator acts as a catalyst for resolution. When faced with high-definition video or a stack of contradictory documents, many dishonest claimants choose to drop their case rather than risk criminal charges. This ends disputes quickly, saving the legal system from being bogged down by unnecessary trials. The presence of a neutral, third-party expert adds a level of objectivity that is hard for either side to ignore.

Gathering Evidence for Legal Proceedings

If a case does go to court, the quality of the evidence is everything. Investigators prepare their findings with the courtroom in mind, ensuring a transparent chain of custody for every photo and document. They understand the admissibility of evidence gathered by PIs and organise their reports so that judges and juries can easily follow the logic. This meticulous approach reassures legal teams that the evidence is credible and legally sound, strengthening their confidence in the investigation’s findings.

Their neutral testimony is often the turning point in a trial. Because the investigator is hired to find the facts rather than to pick a side, their word carries significant weight. They present the data as it is, providing the objective truth that helps the legal system function as intended. This professional approach turns a “he-said, she-said” argument into a factual debate grounded in hard evidence.

Deterring Future Fraudulent Activity

There’s a significant long-term benefit to hiring investigators: deterrence. When the word gets out that a company actively uses professional detectives to vet suspicious claims, people are less likely to attempt fraud. It sends a message that the company is vigilant and that cheating the system carries a high risk of getting caught.

This proactive stance protects the industry’s integrity over time. It cleans up the claimant pool and ensures that resources are reserved for those who genuinely suffer losses. By maintaining a reputation for toughness against fraud, insurance providers create an environment where honesty is the only viable path for policyholders.

Stopping Fraud Before It Costs

The role of private investigators in modern insurance fraud investigations has never been more critical. By combining advanced surveillance, thorough background research, and expert testimony, they safeguard the financial stability of the insurance industry. Insurance fraud leaves a trail of financial harm; it increases costs and creates stricter policies that affect every honest policyholder.

Hiring professional investigators is an investment in truth and accountability. Their expertise distinguishes genuine claims from calculated deceptions, ensuring the system remains fair and reliable for those who need it most. Without skilled intervention, fraudulent activity wouldgom unchecked. Ultimately, private investigators are essential to maintaining integrity, protecting policyholders, and keeping the insurance system functional and trustworthy.