December’s festive rush creates a perfect storm for fraud, with a private detective warning that shopping, delivery and toll scams surge as Australians spend more and stay distracted. Understanding how these scams work and when to seek expert help is key to protecting your money and identity during the holiday season.

Why December Is Prime Time for Scammers, According to a Private Detective

December in Australia is synonymous with sun, surf, and the festive spirit. It’s a time when we focus on finding the perfect gifts, planning summer road trips, and enjoying well-earned breaks with family. However, this same seasonal rush creates an ideal environment for criminals, a risk often highlighted by a private detective who sees seasonal scam patterns firsthand. Scammers know that when you’re busy, distracted, and spending more money than usual, you’re much more likely to overlook a red flag, turning what should be a joyful holiday period into a prime window for sophisticated fraud.

The National Anti-Scam Centre has observed that criminals ramp up their efforts throughout December to capitalise on the high volume of transactions and deliveries. Whether it’s a “limited time” social media deal or an “urgent” text about a missed parcel, these tactics are designed to trigger a panicked response. Staying safe requires a mix of awareness and a healthy dose of scepticism. By understanding the common traps set during the festive season, you can protect your hard-earned money and keep your celebrations stress-free.

Top Scams Targeting Australians This Holiday Season

Recent data from Scamwatch indicates that shopping and delivery fraud are the most prevalent threats during the Australian summer. Between January and October 2025, Australians reported losses of millions of dollars to shopping scams alone. Criminals use the pressure of Christmas shopping and Boxing Day sales to lure victims with deals that seem too good to pass up. They often focus on high-value items like vehicles, pets, designer clothes, and even concert tickets, knowing that people are searching for bargains, which is a trend frequently observed by a private detective investigating seasonal fraud.

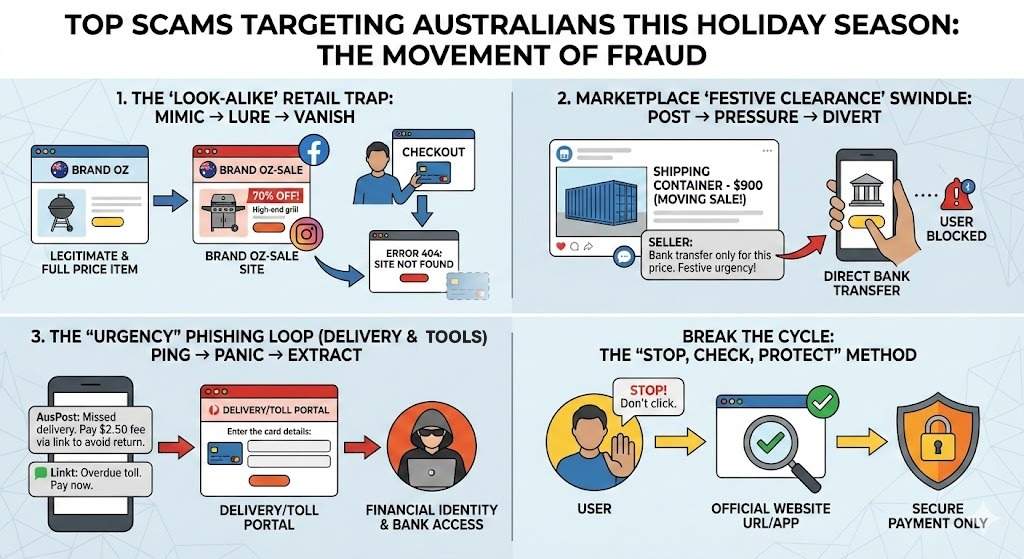

Fake Online Stores and Social Media Deals

The rise of fake retail sites is a significant concern. These websites are meticulously designed to mimic well-known Australian and international brands, using similar logos and layouts to deceive shoppers. You might see a social media ad for a luxury handbag or a high-end grill at 70% off. When you navigate to the site, everything looks legitimate, but once you provide your credit card details, the product never arrives, and the site disappears.

Social media marketplaces are also hotspots for fraudulent sellers. They may post items like shipping containers or cars at incredibly low prices, often claiming the low cost is due to a “festive clearance.” They might pressure you to pay via bank transfer or cryptocurrency rather than through the platform’s secure payment system. If a deal feels too good to be true, it almost certainly is a scam designed to harvest your financial information.

Delivery Notifications and Road Toll Scams

With the sheer volume of packages moving across the country, parcel delivery scams are virtually guaranteed to spike. You might receive an SMS or email claiming you have a “missed delivery” or an “unpaid shipping fee.” These messages usually include a link to a fake website that asks you to enter your card details to “release” the package. This is a direct attempt to steal your identity and access your bank account.

Road toll scams are equally common as families prepare to drive interstate for the summer. You may receive a text stating you have an overdue toll payment and threatening a fine if you don’t pay immediately via the provided link. A private detective advises using the stop, check, protect method: stop before you click, check the service provider’s official website, and protect your identity by never sharing details via unsolicited links. Always use official apps or verified websites to manage your deliveries and accounts.

How a Private Detective Helps You Stay Safe

While being cautious is your first line of defence, some scams are so sophisticated that they bypass even the most vigilant individuals. This is where the expertise of a private detective becomes invaluable. Unlike automated software, a professional investigator brings a human eye and years of experience to identify subtle patterns of fraud. They understand the “scrambling” tactics used by unlicensed gambling apps and can spot the red flags of a fake investment scheme before you commit your funds.

Hiring a professional isn’t just about catching a criminal after the fact; it’s about prevention and verification. If you’re planning a significant purchase from an unknown seller or considering a high-stakes business deal during the holidays, an investigator can perform the due diligence you need to proceed with confidence. They can verify the legitimacy of an entity, ensuring that you aren’t sending your money into a digital void.

Protecting Your Assets from Financial Fraud

Professional investigators use a variety of techniques to trace suspicious activity. For example, if you’ve been targeted by a “scratchie” scam, where a physical card promises a prize in exchange for a fee, a detective can help trace the origins of these mail-outs. They can also assist in cases of identity theft, helping you determine how your data was breached and what steps are necessary to secure your remaining assets.

In the world of online gambling, many Australians lose money to unlicensed sites that refuse to pay out winnings. A private detective can help you understand private investigator prices and rates and determine if an investigation into these “scrambling” platforms is a viable path for recovering your losses. By providing a clear picture of who you’re dealing with, they help you avoid the emotional and financial fallout of a well-executed scam.

Enjoy Your Holidays Without Worries

The festive season should be a time for relaxation, not for dealing with the stress of financial fraud. By staying alert and questioning unsolicited messages, you can significantly reduce your risk of falling victim to a scam. Remember that scammers rely on your haste and the holiday rush to cloud your judgment. Trust your instincts; if an offer or a message feels “off,” it probably is. Always verify the source before you click a link or provide your credit card numbers.

If you suspect you’re being targeted or have already been caught in a scam, don’t hesitate to take action. Report the activity to Scamwatch and contact your bank immediately to secure your accounts. For complex cases or significant financial concerns, reaching out to a professional private detective can provide the clarity and evidence you need to resolve the situation. Stay safe, stay vigilant, and enjoy a secure holiday season with your loved ones.

FAQ

What are the most common scams in Australia in December?

The most common scams involve fake online shopping sites, social media “bargains,” fraudulent parcel-delivery texts, and road toll payment demands. Recently, there has also been a resurgence of “scratchy” scams sent through registered posts.

When should I consider hiring a Private Detective?

You should consider hiring a professional if you suspect you’ve been a victim of a high-value scam, need to verify the legitimacy of a business before a significant transaction, or have had your identity compromised and need to trace the source.

What is the “Stop, Check, Protect” method?

It’s a safety guideline: Stop before sharing money or info; Check that the organisation is real by contacting them through official channels; and Protect yourself by acting quickly and reporting any suspicious activity.